Deal with VAT

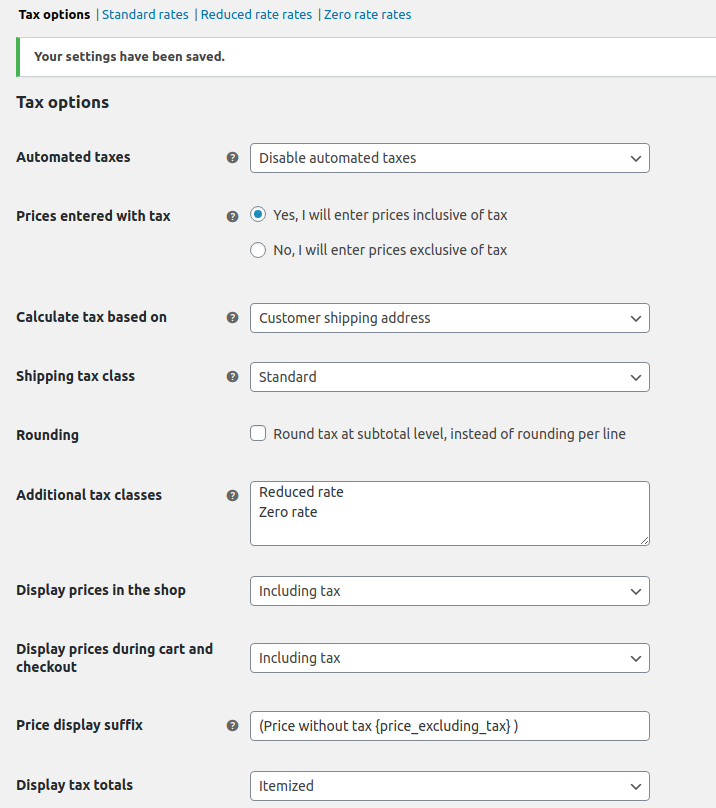

The basic tax settings in WooCommerce are intuitive, and with the right procedure, you will avoid problems with displaying incorrect prices.

- In the VAT section of WooCommerce, click on the Settings tab and decide whether you enter prices with or without taxes.

- The calculation of taxes is subject to several factors — you can calculate VAT depending on the invoicing, delivery address of the customer, or the primary address of the store. This setting is especially important when selling abroad.

- The display of prices in the basket, shop, and checkout is set in the same way.

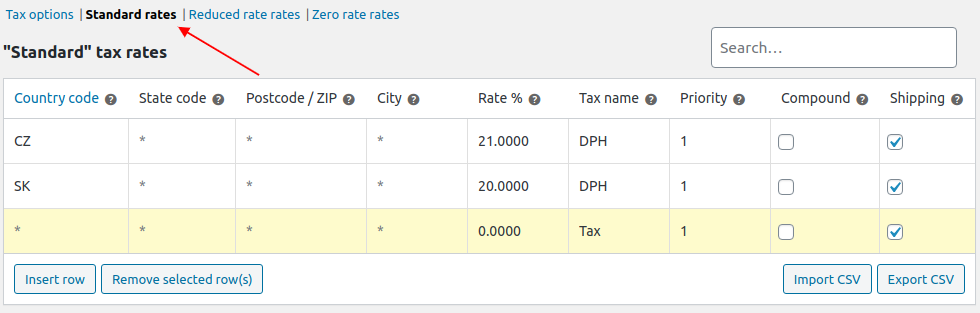

Add tax rates for regions

To set different tax rates, go to VAT -> Standard rates. You can find other tax categories in the appropriate settings, where you can also add lines for the state or city rate.

There the following items in one line:

- Country code — Is two letters, e. g. for the Czech Republic.

- Country code — Not required for Slovakia or the Czech Republic, but is suitable, for example, for the U.S.A.

- Postcode and City — Settings similar to the country code. In some countries, the tax may vary by region.

- Rate — Tax rate in percent, e. g. 21%.

- Name of the tax — In the Czech Republic classically VAT.

- Priority — When applying more rules at the same time. Priority determines which tax is displayed first.

- Compound — Compound tax determines whether a particular tax is calculated based on the price of the product excluding other taxes.

- Recommendation — determines whether the rate applies to transport.

The “*” symbol entered in the line — such a rate applies to all unspecified areas. When you buy from the Czech Republic, and you have entered a tax rate for CZ, this type of rate applies. If you do not set this rate, the tax is 0%.

How to calculate taxes according to the customer’s billing address

If you sell abroad and pay VAT there, setting the tax for a foreign country will make the following example easier:

- The first step is to choose the online store address. For example, if you set it for Slovakia, the tax rate of 20% applies here. You enter prices on the store, including tax, so WooCommerce must first calculate the price without the tax, which is based on the tax rate for the country.

- Then you enter the price of 1,200 EUR including tax for the product, and WooCommerce calculates the price without the tax 1,200 / 1.20 = 1,000 EUR.

- If the customer has a billing address in the Slovak Republic, the price of EUR 1,200 will be displayed in the Cashier. If the customer has a billing address in the Czech Republic, WooCommerce will recalculate the price according to the tax rate of 21%, and the price will be without tax 1,000 * 1.21 = 1,210 EUR.

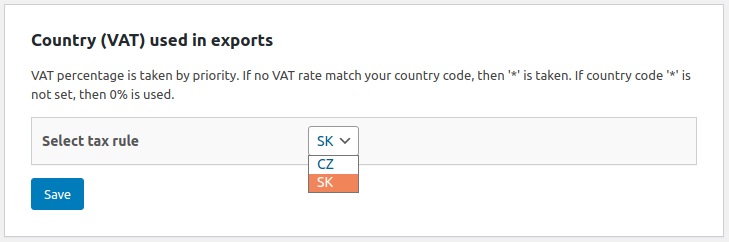

The Mergado Pack exports product feeds for various tax rates according to the WooCommerce settings. In the Mergado Pack administration, on the Settings page, choose which tax rate you will use in the export.

Mergado Pack can only work with rates according to the country code. It can’t work with advanced tax rates by state, postcode or city yet, but you won’t even use it in these conditions.

If you set the SK rate — 20%, the price without tax of EUR 1,000, a price with the tax of EUR 1,200, and the tax of 20 (in percent) will be overwritten in the XML feed.

<VAT>20.0000</VAT>

<PRICE_VAT>1200</PRICE_VAT>

<PRICE>1000</PRICE>

If you use the CZ 21% rate for export, the feed will generate a price without tax of EUR 1,000, a price with the tax of EUR 1,210, and a tax of 21 (in percent).

Make the creation of an online store easier. Using our free Mergado Pack you connect your business to the biggest marketing channels.